You need a personal account number(PAN) if you are a tax payer, or you want to file your income. A PAN number is a ten-digit number in alphabets and numerical, or in ‘alphanumeric’ terms, that is allocated by the income tax department. Its a proof for checking your tax payments. As the pan is linked to the banks it is easy track to all your financial transactions for the income tax department. The PAN holds all the information about tax payments.

PAN also serves as a identity card and its mandatory in India to open a bank account, to do any transactions above 50,000 rs, when you are applying for loans or debit/ credit cards, for insurance payments and when starting an FD account or foreign currency exchange. It is also essential to submit your PAN when you buy or sell property and vehicles and when purchasing jewelleries.

You can follow some simple steps to get a PAN through online by signing in to TIN-FC or UTITSL or NSDL PAN centre. You can apply for a pan card through both online and offline methods.

You have to be ready with few documents before you start to apply for a PAN card through online. These identity proofs are must to apply for a PAN card.

A government issued id entity card with photograph such as aadhar card, Elector’s photo identity, Passport, Driving licence.

For address proof you can submit consumer gas connection card, bank account statement or credit card statement.

And also a school leaving certificate, or birth certificate to confirm your date of birth.

To apply for a PAN card online, you have to visit the mentioned official websites like NSDL. . You can fill in the information which needs to be submitted.

Click on the option ‘Apply Online’ on the top left corner since you are a new applicant.

- In the drop-down, you can select one from the three options which are:

- New PAN – Indian Citizen

- New PAN – Foreign Citizen

- Changes or Correction on Existing PAN/Re-print of PAN card.

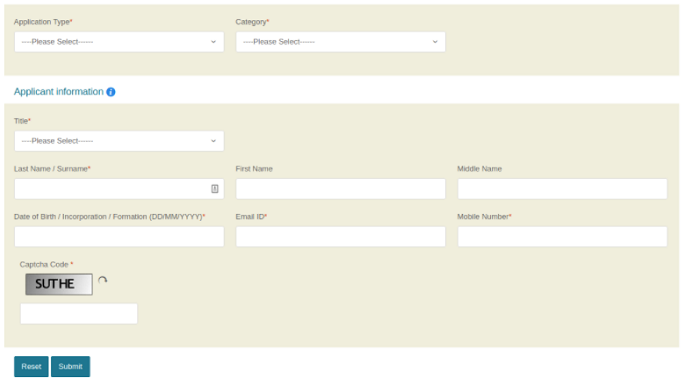

Fill in the details like application type(form 49A for Indian citizens)

select the ‘Category’. The category list includes options such as

individual,

company,

In the drop-down, you can select one from the three options which are: New PAN – Indian Citizen

- New PAN – Foreign Citizen

- Changes or Correction on Existing PAN/Re-print of PAN card.

Fill in the details like application type(form 49A for Indian citizens)

select the ‘Category’. The category list includes options such as

individual,

company,

An associate of individuals,

Hindu Undivided Family,

Trust, Limited Liability Partnership,

local authority, etc.

After choosing any one of the following options, you will need to fill in your details.

The information must be provided for these sections:

- Title

- Last name

- First name

- Middle name

- Date of Birth

- Email ID

- Phone number

After filling up the required information, you will have to re-type a captcha code and then click on ‘Submit’.

After submitting, the website provides you with a 15-digit acknowledgement number. Note the acknowledgement number and proceed with PAN application.

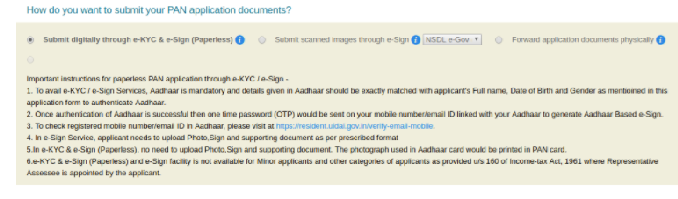

You will be redirected to the page where you have three options to submit your documents to process your pan card application.

You can submit your documents digititally by scanning the images and e-sign or forwarding the documents physically.

If you are going to process it physically along with the application, you will have to send a demand draft of Rs.107 including tax. If the PAN application needs to be sent outside India, an additional amount of Rs.887 must be The form must be sent to the given address along with a copy of your ID proof and address proof to – INCOME TAX PAN SERVICES UNIT (Managed by NSDL e-Governance, Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

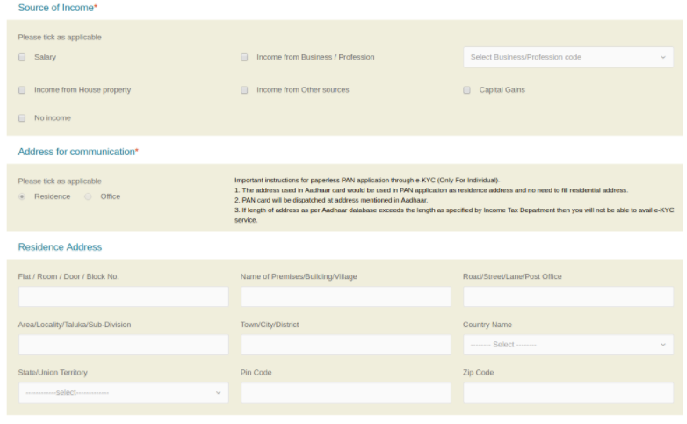

If you click the option to submit digitally through e-KYC and e-Sign, you will be directed to the next page where you need to submit the details regarding your source of income, address and contact information.

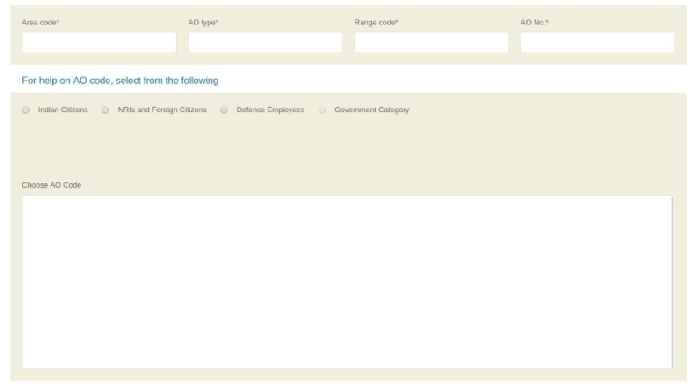

The next you are directed needs to enter details about your accessing officer, details to access the tax jurisdiction you qualify for. You will find this information on the same page. After filling the details, click on ‘next’.

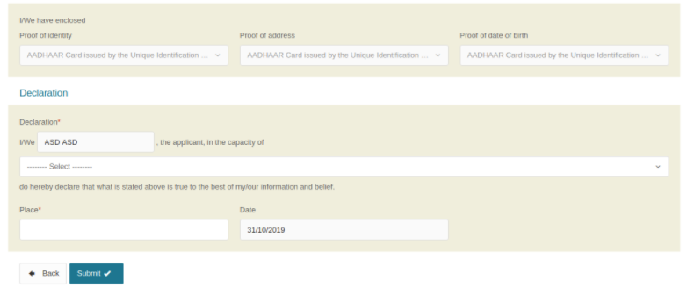

And as the last step you need to enter the details about the documents submitted as proof of identity, address proof, and date of birth. You also need to upload your signature and photograph. After uploading you have to click ‘submit’

After submitting the application and making payment you will get an OTP on your mobile number which is been linked to your aadhar card. You need to enter the OTP to print the receipt with the 15 digit acknowledgement number.

You will get the e-pan in 10 0r 15 minutes after this process. You can print and use it as your pan card. If you want a card type PAN card click the option as well for permenant card . you will receive a pan card in 10 or 15 days.